This guide explains exactly how to buy property in Dubai, step by step. You will learn what to expect at each stage, how much you will typically pay, what paperwork is required, and where common traps hide. If you follow the process below, you will have a clear, practical roadmap for buying property in Dubai with no surprises.

Quick roadmap

- Step 1: Expression of Interest (EOI)

- Step 2: Selecting the unit

- Step 3: Negotiating the terms

- Step 4: Booking

- Step 5: Down payment and DLD fee

- Step 6: Signing the SPA (Sales and Purchase Agreement)

- Step 7: Oqood (digital ownership certificate)

- Step 8: Payments during construction

- Step 9: Right to sell on the secondary market

- Step 10: Handover and rental / resale options

Step 1 — Expression of Interest (EOI)

An Expression of Interest (EOI) is a refundable prepayment that secures your place in the queue before a project launches. Typical minimums are something like $10,000 or 2% of the unit value, but there is no formal maximum. The larger your EOI, the better your position can be in allocation for hot projects.

Key points:

- Refundable: If you don't get the unit or you change your mind, the developer returns the EOI (usually within a month).

- Use cases: before launch, when you missed the launch and want priority for cancellations, or when the project has not been announced and the developer releases units to EOI holders first.

Step 2 — Selecting the unit (allocation day)

On allocation day, developers handle unit selection differently. Some let buyers choose from a long list, others run lotteries, and some allocate a few units per buyer. Bulk buyers often secure the best stock early — it's common to see investors taking 20–40 units at once — so coming early matters for highly demanded launches.

If a unit remains after allocation it becomes publicly available. Not being selected on launch day does not mean the unit is bad — cancellations happen.

Step 3 — Negotiating the terms

You can often improve the initial terms. Focus on three negotiable items:

- Price reductions: Small developers on low-demand stock may give 2–3% off. For larger or mid-market projects you might achieve 3–5%, and paying 100% cash can sometimes net up to 10% from certain developers. Bulk purchases (entire floors) can see 10–20% discounts.

- DLD waiver: The Dubai Land Department fee is generally 4% of the property price. Developers sometimes offer a partial or full waiver.

- Payment plan adjustments: Standard splits like 70/30 (construction/hand‑over) can sometimes be changed to 60/40, 55/45, or have payments pushed later to reduce your outlay in the first year.

Remember: for extremely hot projects, pushing for concessions may cost you the unit. Prioritize what matters most.

Step 4 — Booking

Booking uses a short document that records the main purchase terms: buyer details, unit number, size, expected completion date, price and payment schedule. Signing the booking form does two things:

- You secure the unit and the agreed terms.

- Your EOI usually becomes non-refundable — canceling after booking typically means the developer keeps the EOI amount.

A booking payment may be required after signing. This is often equal to the EOI minimum but can be as high as 10% of the property price.

Step 5 — Down payment and DLD fee

The down payment is usually 20% of the purchase price (sometimes 10%). Ideally this goes to the project's escrow account, but new projects often require payment to the developer's general account until the escrow is set up. This is normal when buying right after launch.

You will also pay the 4% Dubai Land Department fee (DLD) and a developer's fee (roughly $1,500, varies). The DLD payment is required to register the unit; the developer usually forwards this fee to the DLD on your behalf.

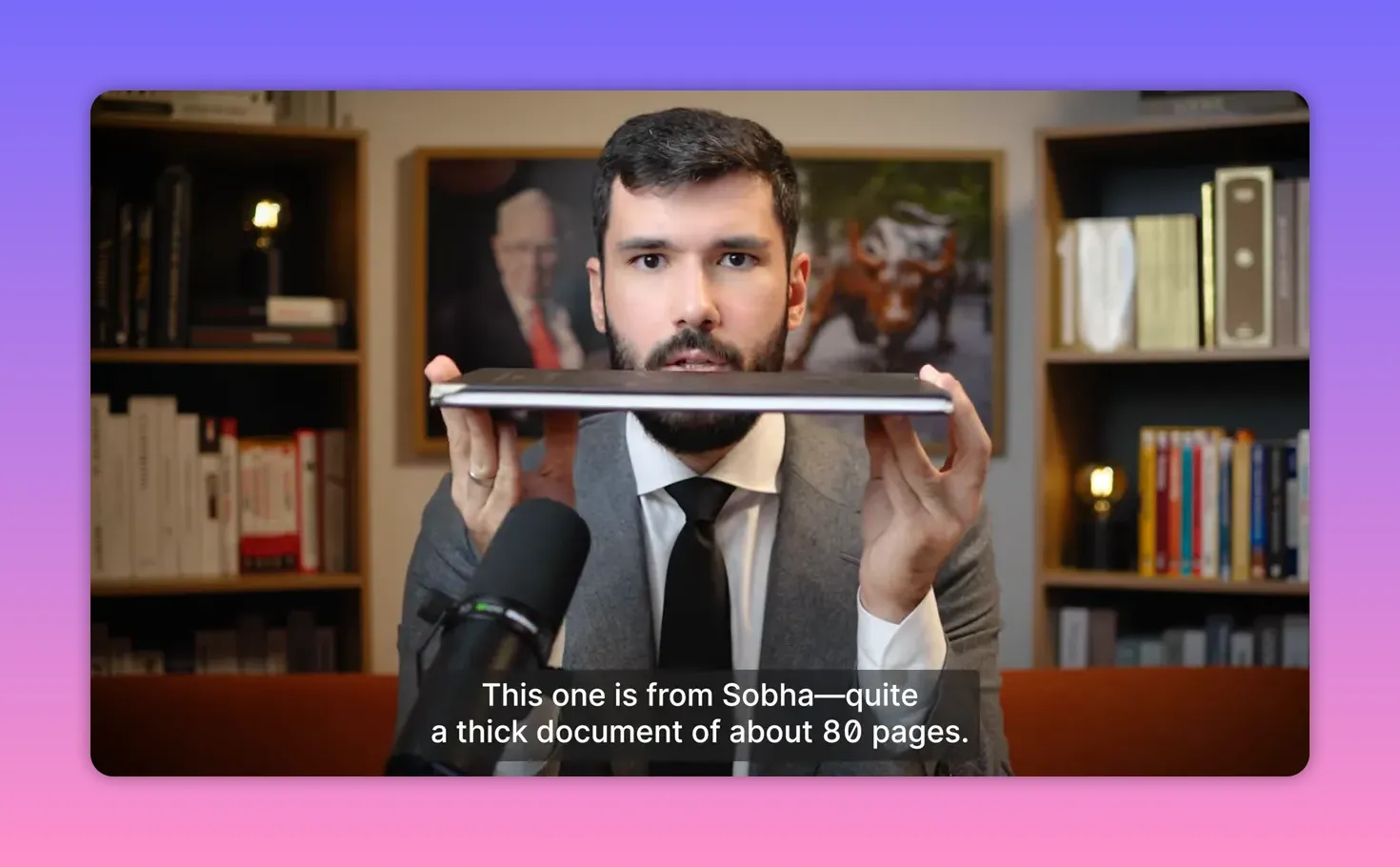

Step 6 — Signing the SPA (Sales and Purchase Agreement)

The SPA is a detailed contract (often 50–80 pages) describing the unit, finishes, payment milestones, penalties for missed payments, handover procedures and defect rectification. Many developers allow digital signing, and the entire purchase process can be handled remotely.

If the project just launched, expect to wait a few months for the SPA to be issued.

Step 7 — Oqood certificate (digital ownership for off-plan)

After SPA signing you receive an Oqood (digital certificate) issued by the Dubai Land Department for off-plan transactions. It proves ownership during construction and is required if you plan to sell the unit before completion. The Oqood is also necessary for applications such as the Golden Visa when the property exceeds the minimum value requirement.

Step 8 — Payments during construction

Follow the payment schedule tied to dates and construction milestones. Common payment methods:

- Cash

- Local bank check (developer deposits it)

- Card payment (some cards may be rejected; banks can block large transactions)

- Wire transfer (ensure you include the developer's IBAN or their bank may not receive funds)

- Crypto (USDT is accepted by many developers)

If you miss payments, the process usually goes: developer reminders, a DLD 30‑day notice, then potential cancellation and auction or retention of a percentage of the paid amount depending on project completion. Communication early is critical if payment issues arise.

Step 9 — Right to sell before completion

You can sell an off-plan unit once you have paid the threshold amount (commonly around 30–35%, sometimes up to 50%). To sell you will need a No Objection Certificate from the developer (cost ~ $1,000).

Selling off-plan has challenges:

- Buyers often prefer ready properties.

- If the developer still has inventory, buyers may purchase directly from them.

- Buyers seeking mortgage financing typically wait for handover.

Step 10 — Handover, title deed and renting

Handover starts with a snagging inspection. The developer will fix defects discovered at this stage. After corrections you receive the title deed confirming full ownership.

Financing at handover: if you didn't get a mortgage earlier, you can convert a final payment into a mortgage. Non-residents who obtain residency (for example via a Golden Visa during construction) find it easier to secure a mortgage, often up to 25 years.

Rental options

- Long-term rental: Rent the apartment as-is. Tenant covers maintenance and typically agency fees. Expect service charges of roughly $3–$6 per sq.ft per year depending on the building.

- Short-term rental (Airbnb): Furnish and use a management company. Higher returns in prime tourist areas but seasonal and requires active management and additional costs.

Common pitfalls and red flags

Watch for:

- Bulk buyers absorbing desirable stock at launch.

- Developers that delay escrow registration for long periods.

- Unrealistic marketing claims about returns or occupancy.

- Projects with weak location fundamentals — rentals and resale suffer.

Do due diligence on the developer, read the SPA carefully, and verify escrow and construction progress reports before making sizable payments.

Final checklist before you buy

- Confirm EOI terms and refund timeframe.

- Verify allocation rules and whether a lottery or direct pick applies.

- Negotiate price, DLD contribution, or payment schedule where possible.

- Understand booking consequences and whether your EOI becomes non-refundable.

- Check escrow status, developer reputation and previous deliveries.

- Plan payment methods and ensure bank transfers include the correct IBAN.

- Decide early if you intend to rent long-term or short-term; factor service charges and management fees.

Following this process will make buying property in Dubai straightforward and manageable. Use the checklist, prioritize what matters most for your investment goals, and keep open lines of communication with the developer or an experienced agent to avoid costly surprises.